What is money laundering or asset laundering?

Before delving into this law, we must answer this question. Money laundering, also known as asset laundering, es una serie de trucos financieros que la gente usa para “limpiar” dinero sucio y hacer que parezca que proviene de actividades legales. It's like putting a disguise on the money so that no one realizes its illegal origin.

They can do this by moving the money through bank accounts, investing it in legal businesses, or even buying expensive things like properties. Then, the money looks clean, and no one suspects.

Law 155-17 on Money Laundering in the Dominican Republic

Law 155-17 in the Dominican Republic, also known as Law Against Money Laundering and the Financing of Terrorismis crucial legislation in the country. Its goal is to prevent and combat money laundering and terrorism financing within the Dominican territory. Here are some highlights of this law:

Creation of the UAF (Financial Analysis Unit):The law establishes the creation of the Financial Analysis Unit, responsible for supervising and analyzing financial and commercial transactions to detect potential money laundering and terrorism financing activities.

- Reporting Obligations:The law imposes an obligation on financial institutions, businesses, and designated professionals (such as lawyers and accountants) to report suspicious transactions to the UAF.

- Due Diligence:The legislation sets due diligence requirements to verify the identity of clients and continuously monitor transactions, especially for politically exposed persons (PEPs) and high-risk business activities.

- Sanctions:The law provides for both administrative and criminal sanctions for those who violate its provisions, including fines and imprisonment.

- International Cooperation:The Dominican Republic is committed to international cooperation to prevent money laundering and terrorism financing, including the extradition of individuals sought for these offenses.

- Supervision and Regulation: The law establishes a regulatory framework to oversee financial institutions and other entities subject to its provisions.

Who are the obligated subjects under this law?

Obligated subjects? Obligated subjects are individuals, companies, or organizations legally required to comply with specific measures to prevent money laundering and terrorism financing.

They must implement policies and due diligence procedures to identify, prevent, and report suspicious transactions.They are required to conduct due diligence in identifying their clients and maintain proper records of their operations.

Under this law, obligated subjects to report include, but are not limited to:

- Financial Institutions: Banks, insurance companies, exchange houses, and other financial institutions handling monetary transactions and assets.

- Real Estate Agents: Individuals or organizations involved in buying, selling, or leasing properties are subject to these regulations.

- Lawyers and Notaries: Legal professionals may be involved in financial transactions and, therefore, must comply with anti-money laundering regulations.

- Jewelers and Precious Metal Traders: Those selling precious metals, gems, and jewelry are also included.

- Casinos and Gambling Establishments: Establishments handling large sums of cash. Online Gambling Companies: Includes online betting and gaming platforms.

- Electronic Gaming Operators: This covers slot machines and other electronic gaming devices.

- Customs Agents and Customs Warehouses: Those involved in imports and exports.

- Accountants and Auditors: Accounting professionals with key financial information.

- Electronic Gaming Operators: This covers slot machines and other electronic gaming devices.

- Other Designated Sectors: Any other sector or business that authorities determine as high-risk in terms of money laundering and terrorism financing.

What is the UAF, and what are its functions?

The UAF acts as a kind of “financial detective” that follows the trail of money. Imagine someone steals money or obtains it illegally and then tries to hide it or spend it — the UAF is there to uncover it and ensure those individuals don’t get away with it.

- It collects information on money transactions, such as deposits, bank transfers, or significant purchases.

- It analyzes this information to find clues that may indicate suspicious activities.

- If it discovers anything unusual, it reports it to the authorities for further investigation.

In summary, the UAF is the financial “hero” that protects our money and economic security in the Dominican Republic.

What is goAML?

goAML is a tool that assists the UAF in its work.This tool was created by the United Nations and designed to help the Financial Intelligence Units of each country.

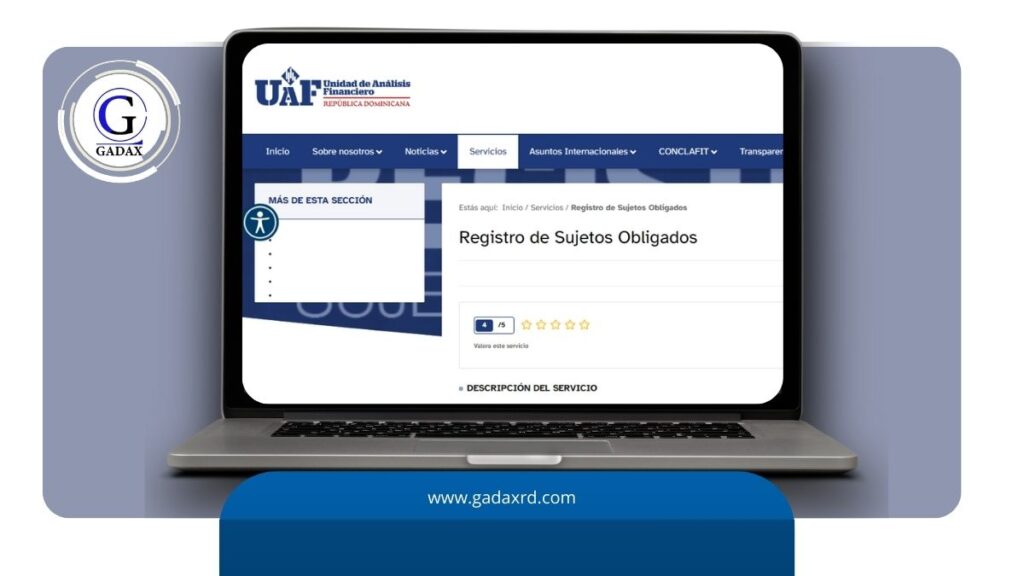

How to register with the UAF?

- Step 1: Check if You’re an “Obligated Entity” The UAF works with what are known as “Obligated Entities.” These are essentially businesses or organizations that must comply with specific regulations designed to prevent illegal activities such as money laundering or terrorism financing. Check whether your company is considered an “Obligated Entity” according to UAF regulations.

- Step 2: Appoint a “Compliance Officer” If your company qualifies as an “Obligated Entity,” you need to appoint someone to serve as your Compliance Officer. This person is responsible for ensuring that your business follows all UAF rules and requirements.

- Step 3: Complete an online form. .** Visit the UAF website (Registration of Obligated Subjects (uaf.gob.do)] find and complete the registration form with your company’s information. This includes details about your business and your designated Compliance Officer.

- Step 4: Validation and credential creation. The UAF will verify the information you provided. If everything is in order, they will give you the access credentials you need to submit certain reports that are crucial for preventing illegal activities.

- Step 5: Access testing and confirmation. Make sure your company’s Compliance Officer has access to the UAF’s online platform. This step ensures everything is working correctly. Once the access is verified, your company will be fully ready to meet its compliance obligations.

If you have more doubts or questions, you can contact the UAF directly at consultas@uaf.gob.do or by phone at Tel.: (809) 682-0140.

In conclusion, Law 155-17 Against Money Laundering and the Financing of Terrorism in the Dominican Republic is a crucial tool in the fight against money laundering and the protection of the integrity of the country's financial system. Through the Financial Analysis Unit (UAF), transactions are supervised and analyzed to detect any suspicious activity, ensuring the economic security of the nation..

Obligated subjects play a fundamental role in this effort by reporting suspicious transactions and complying with established regulations. By understanding the importance of this law and how to register with the UAF, businesses and professionals can contribute significantly to preventing illegal activities and strengthening the economy of the Dominican Republic.

If you are interested in learning more about the laws of the Dominican Republic, you can read our blog.

Ensure financial transparency with our step-by-step guide to UAF registration. Prevent money laundering and protect your business.